- Money254 Money Weekly

- Posts

- Govt Loses Ksh912M to Ghost Students, Kenya Renegotiates SGR Loan Terms

Govt Loses Ksh912M to Ghost Students, Kenya Renegotiates SGR Loan Terms

Ministry of Education audit exposes 973,634 ghost students in schools. Govt renegotiates with China to change SGR loan terms. Safaricom launches Ziidi Trader, allowing Kenyans to invest in stocks without a CDS account. CA bans sale of 21 phone brands. All these stories are in today’s Money Weekly Newsletter, but first, we cover ghost students in schools.

Hello and welcome to the Money Weekly Newsletter, where we are covering the audit that has exposed ghost students in schools.

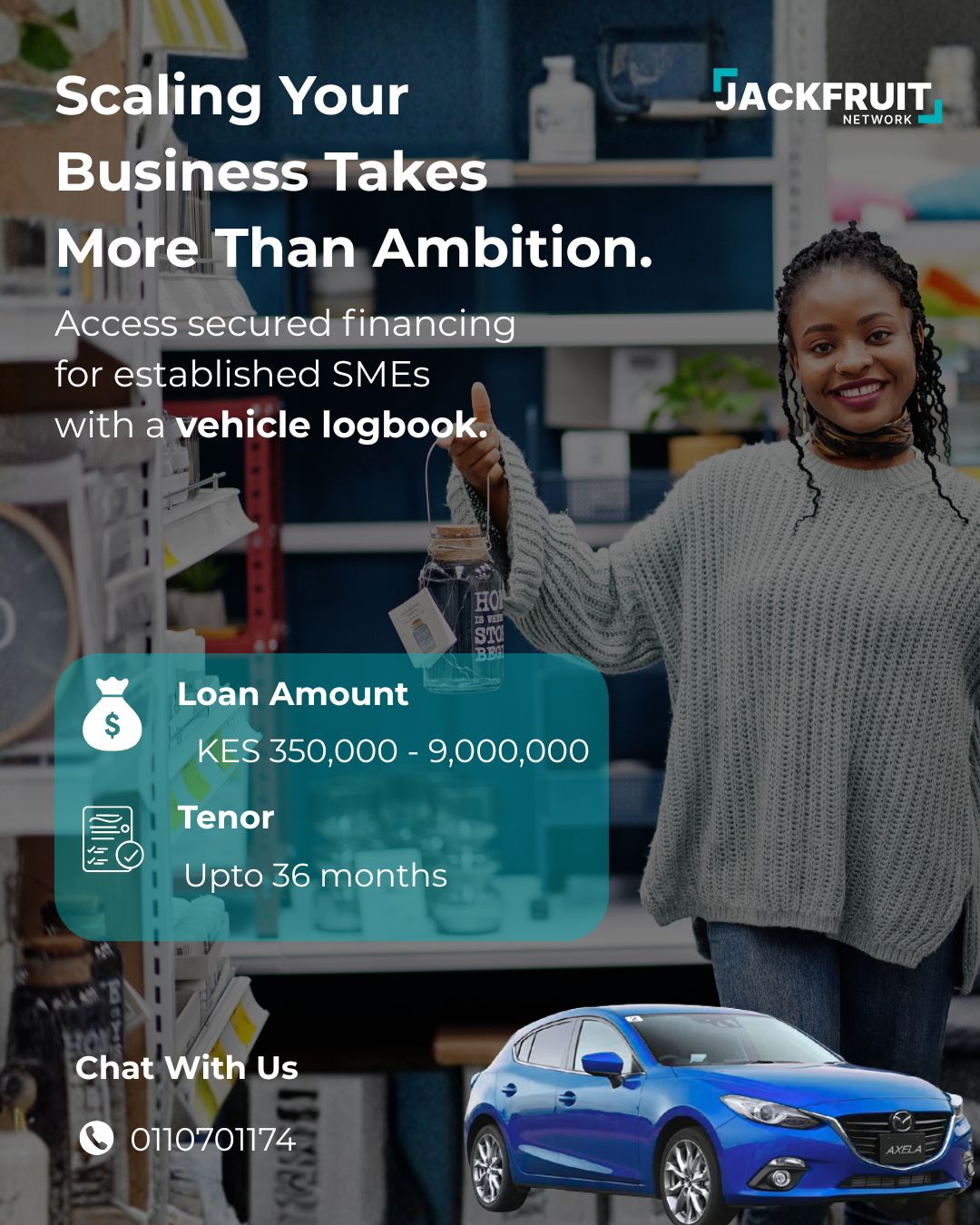

But first, a word from Jackfruit Finance.

Sponsored Content

Have you ever taken a loan for your SME where the interest stays fixed no matter how fast you repay?

With Jackfruit, you don’t get a fixed rate. You can access up to Ksh1 million and only pay interest on the outstanding balance, meaning the faster you repay, the less interest you are charged.

Govt Loses Ksh912M to Ghost Students in 3 Months

An audit by the Ministry of Education has exposed 973,634 ghost students in schools across the country that the government was paying capitation for.

According to Education Cabinet Secretary Julius Ogamba, 885,904 ghost students registered on the National Education Management Information System (NEMIS) were from primary school, while 87,730 were from secondary schools.

While the government did not detail the total amount that was lost in the payment of capitation, Ogamba revealed the Ministry paid Ksh912 million in capitation for the 87,730 ghost secondary students in Term Three of 2025.

The audit of primary schools established that out of 5,833,175 primary school learners registered in the NEMIS system, only 4,947,271 could be verified.

Meanwhile, it was established that there was underreporting for students in Junior Secondary Schools. NEMIS recorded 2,430,398 learners, but verification found 4,947,271 students enrolled across all public junior schools.

The audit also flagged 14 institutions that failed to submit data during the audits. Additionally, 102 junior and 84 primary schools were found to be operating below minimum enrolment thresholds.

As a result, the Ministry has submitted its findings to the Directorate of Criminal Investigations (DCI) for further analysis on the criminal culpability of the school head and ministry officials.

"Data entry in NEMIS is done at the school level. Heads of Institution are the custodians of school data and are personally responsible for the accuracy, completeness, and timeliness of all learner records entered into the system. Any deliberate falsification, inflation, or misrepresentation of enrolment data constitutes gross misconduct and a breach of public trust.

"Similarly, Sub-County Directors of Education are responsible for oversight, supervision, and validation of schools within their jurisdiction. Where discrepancies occurred and were ignored, condoned, or failed to be escalated, administrative responsibility arises," read the statement in part.

Here is a quick recap of the top news stories for the week:

Kenya is in talks with Chinese lenders over a clause linked to the Standard Gauge Railway (SGR) that currently commits proceeds from the Railway Development Levy (RDL) to repaying earlier railway loans.

The government is seeking to have the provision lifted to allow the issuance of a 15-year Ksh390 billion bond aimed at extending the SGR from Naivasha to Malaba. Treasury Cabinet Secretary John Mbadi said negotiations are ongoing with the Export-Import Bank of China to permit the levy to be used as security for the proposed bond instead of servicing existing debt.

Catch Up on More News

WEEKLY MONEY TIPS

MONEY254 #MONEYTOK

The Money-Saving Question Most SME Owners Fail to Ask Before Taking a Loan

Imagine you’ve just landed a big contract and need capital fast, but cash is tight. You approach a lender, confident in your business, only to realise you don’t have all the required documents.

When you look elsewhere, you risk accepting an expensive loan that could eat into your profits. Many SME owners make the mistake of focusing only on the advertised rate, with logbook loans often showing rates of around 5% per month.

But not all interest is calculated the same. In this video, we explain why a reducing balance loan — like the one offered by Jackfruit — can be cheaper than a flat-rate loan, and how to avoid overpaying on interest.

Jackfruit offers loans of Ksh350,000 to Ksh1 million to SMEs across Kenya, with approvals in as little as 24 hours at affordable rates.

That’s a wrap for this week’s Money Weekly!

Remember that we can help you compare over 300 loans, savings accounts, current accounts, and more on our website if you’re thinking about your next product.

❤️ Share with a friend

Thanks for reading. If you liked this week’s Wallet Wellness email, we’d love for you to share it with a friend.

If this email was forwarded to you, you can subscribe here.

%20(1).jpg)