- Money254 Money Weekly

- Posts

- Govt Proposes Increasing VAT to 18%, Young Kenyans to Get Early Access to Pension Funds

Govt Proposes Increasing VAT to 18%, Young Kenyans to Get Early Access to Pension Funds

The Parliamentary Budget Office (PBO) proposed an increase in VAT from 16% to 18%. Govt proposes reforms in the pension system to enable Kenyans access part of their savings for financial emergencies. SACCOs to fund KUSCCO through membership fees. All these stories are in today’s Money Weekly Newsletter, but first, we cover proposals to increase VAT.

Hello and welcome to the Money Weekly Newsletter, where we are covering the proposed increase of VAT to 18%.

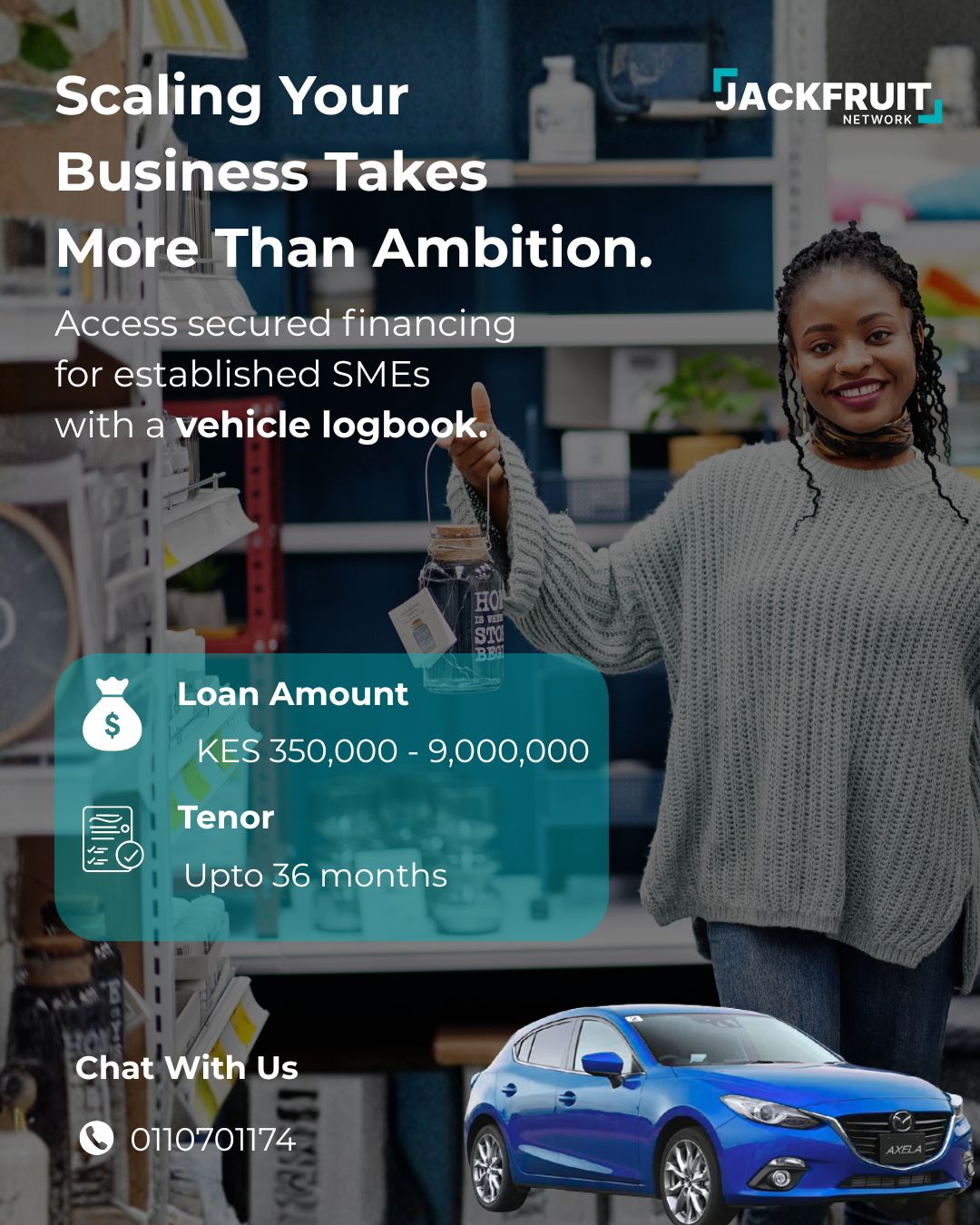

But first, a word from Jackfruit Finance.

Sponsored Content

Have you ever taken a loan for your SME where the interest stays fixed no matter how fast you repay?

With Jackfruit, you don’t get a fixed rate. You can access up to Ksh1 million and only pay interest on the outstanding balance, meaning the faster you repay, the less interest you are charged.

Govt Proposes Increasing VAT to 18%

The Parliamentary Budget Office (PBO) has proposed increasing Value Added Tax (VAT) from 16% to 18% as part of the strategy to raise additional revenue to help clear pending bills in government.

PBO, created in May 2007, is a non-partisan office in Parliament that supports MPs by analysing budgets, economic forecasts and financial legislation to strengthen oversight of public finance.

According to the budget experts, the increase of VAT could generate an additional Ksh87 billion in the 2026/27 financial year.

PBO noted that the additional revenue could help the government pay pending bills that are estimated to have reached Ksh468 billion in December 2025

Some of the offices that have the highest pending bills include the State Department for Roads (Ksh130.4 billion), public universities and colleges (Ksh73.3 billion), and Energy (Ksh57 billion).

Notably, VAT is one of the taxes that the World Bank recommend reforms on. In May 2025, the World Bank proposed the imposition of 16% VAT on meat, wheat flour, avocado and coffee

The lender, in its recommendations, noted that the increase in VAT would help the government raise funds to help vulnerable families.

“Since a big space of poor households’ shopping basket is taken up by food, most foodstuffs are either exempted or zero-rated from VAT to cushion them from a spike in price whenever there is a poor harvest,” the World Bank wrote in its Kenya Economic Update.

The proposal comes amid the preparation and tabling of the 2026 Finance Bill. In readiness for the preparation of the Finance Bill 2026 and the 2027/2027 Budget, the cabinet approved the 2026 Budget Policy Statement.

If the proposal by PBO is adopted, several goods, such as fuel, could increase. For instance, for a litre of petrol in Nairobi that costs Ksh178, Ksh24 goes to VAT (which is charged at 16%).

Here is a quick recap of the top news stories for the week:

The Retirement Benefits Authority (RBA) has proposed changes in the pension sector that may enable Kenyans to access a portion of their pension savings early for education, housing, and medical expenses.

The “two-pot” pension reform will channel part of contributions into a separate account that members can tap during financial hardships, while preserving the bulk for retirement. Currently, pension benefits can only be accessed before age 50 if unemployed or changing jobs; financial hardship is not recognised.

Catch Up on More News

WEEKLY MONEY TIPS

MONEY254 #MONEYTOK

Proposal Increasing VAT to 18% Gets Support from Parliament's Budget Team

Kenyans could soon pay more for goods and services after the Parliamentary Budget Office (PBO) backed a proposal to raise VAT from 16% to 18%. If adopted, this would directly affect the cost of many everyday items.

The proposal first gained attention in May 2025 when the World Bank recommended increasing VAT to 18%, estimating it could raise an additional Ksh 50 billion to support vulnerable populations. The PBO now argues the higher rate could also help the government clear pending bills owed to suppliers, currently at about Ksh 575 billion.

So what would an 18% VAT rate mean for your shopping, business costs, and overall cost of living? In this video, we break it down in simple terms.

@money254hq 𝐏𝐫𝐨𝐩𝐨𝐬𝐚𝐥 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐢𝐧𝐠 𝐕𝐀𝐓 𝐭𝐨 𝟏𝟖% 𝐆𝐞𝐭𝐬 𝐒𝐮𝐩𝐩𝐨𝐫𝐭 𝐟𝐫𝐨𝐦 𝐏𝐚𝐫𝐥𝐢𝐚𝐦𝐞𝐧𝐭'𝐬 𝐁𝐮𝐝𝐠𝐞𝐭 𝐓𝐞𝐚𝐦 Kenyans could soon pay more for goods and services after the Par... See more

That’s a wrap for this week’s Money Weekly!

Remember that we can help you compare over 300 loans, savings accounts, current accounts, and more on our website if you’re thinking about your next product.

❤️ Share with a friend

Thanks for reading. If you liked this week’s Wallet Wellness email, we’d love for you to share it with a friend.

If this email was forwarded to you, you can subscribe here.

%20(1).jpg)