- Money254 Money Weekly

- Posts

- Ksh1.2 Trillion SACCO Savings at Risk, BRT in Limbo as Trump Withdraws Funding

Ksh1.2 Trillion SACCO Savings at Risk, BRT in Limbo as Trump Withdraws Funding

Govt targets 25,000 SACCOs for closure over non-compliance. Trump cancels Ksh7 billion deal that was to fund the BRT project in Nairobi. Government makes last-minute changes to Nairobi-Mau Summit road deal.TSC and KPA announce job vacancies. All these stories are in today’s Money Weekly Newsletter, but first, the planned closure of SACCOs.

Hello and welcome to the Money Weekly Newsletter, where we are covering why 25,000 SACCOs are at risk of being closed by the government.

But first, a word from Jackfruit Finance

Sponsored Content

Are you a school owner looking to expand, upgrade your facilities, or buy a school bus? Our partner, Jackfruit Finance, offers a financing solution designed exclusively for schools.

Access up to Ksh9 million in just 48 hours to grow your school. Whether it’s building new classrooms or acquiring essential assets, Jackfruit provides friendly terms and flexible repayments — not fixed monthly instalments.

Apply for the Jackfruit Project & Asset Loan today and take your school to the next level. Apply here

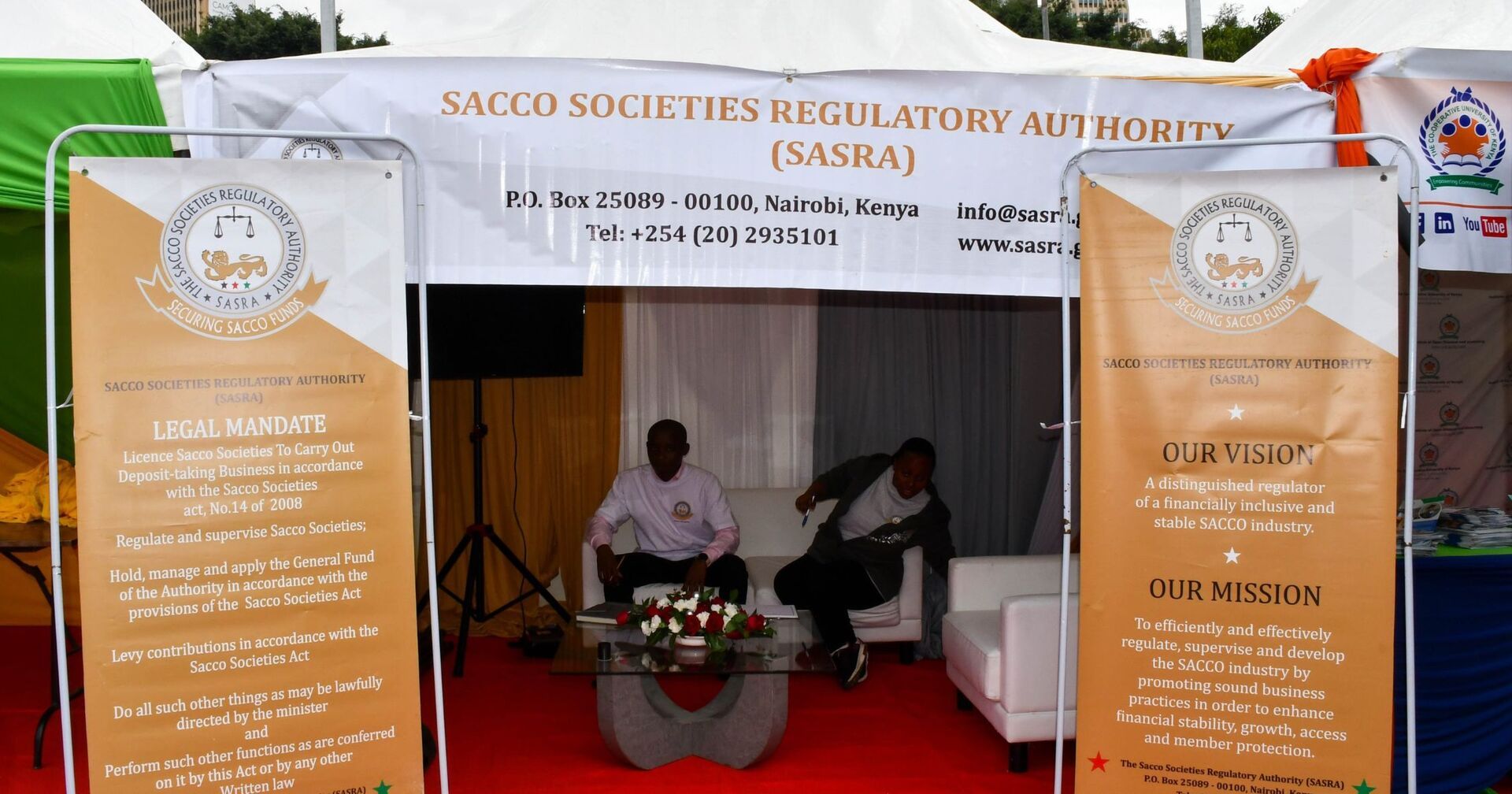

Ksh1.2 Trillion SACCO Savings at Risk

Over Ksh1.2 trillion SACCO deposits are at risk following the government's plan to deregister 25,000 credit societies for non-compliance.

According to the State Department for Co-operatives, the SACCOs being targeted have failed to comply with statutory reporting requirements, including filing audited financial accounts.

Data from the government department shows that only less than 5,000 SACCOs have complied with the directives to file audited books.

The government also accused the SACCOs of failing to hold Annual General Meetings.

"Compliance is not a suggestion. It is a legal and moral obligation. We now want to commence the process of cancelling registration certificates of all non-compliant co-operatives. We will sustain enforcement and ensure we protect co-operative members from mismanagement, secrecy, and financial abuse," Cooperatives PS Patrick Kilemi stated.

As stipulated in the Co-operative Societies Act, failure to submit audited accounts within four months after the end of a financial year can lead to deregistration.

The law also strips management committee members of office where audits are delayed, barring them from seeking re-election for three years.

"Where a co-operative society has (a) less than the prescribed number of members; or (b) failed to file returns with the Commissioner for a period of three years; or (c) failed to achieve its objects, the Commissioner may, in writing, order the cancellation of its registration and dissolution of the society and the order shall take effect immediately," reads the Act in part.

The latest crackdown comes at a time when SACCO members have lost their hard-earned money through questionable deals by officials.

Notably, the government has been keen to enforce regulation of the sector following the Ksh13 billion scandal at the Kenya Union of Savings and Credit Cooperatives (KUSCCO).

Officials of KUSCCO are accused of cooking books, forging a dead auditor's signature, and taking out loans (amounting to millions) and failing to pay them.

Here is a quick recap of the top news stories on education for the week:

US President Donald Trump cancelled a Ksh7.76 billion ($60 million) deal that Kenya had signed with former President Joe Biden to fund Nairobi’s Bus Rapid Transit (BRT) project.

The agreement, signed on September 19, 2023, in New York and activated in May 2024 during President Ruto’s state visit to Washington, was set to run until June 2027. The cancellation directly affects BRT Line 2 (Simba), planned to connect Rongai, Bomas, the CBD, Ruiru, Thika, and Kenol.

Catch Up on More News

WEEKLY MONEY TIPS

MONEY254 #MONEYTOK

Safaricom Unveils Terms of Its Tax-Exempt Bond: How to Invest

Safaricom has announced a 5-year tax-exempt bond under its MTN Programme, giving Kenyans a chance to earn returns while supporting sustainable projects. In this video, we break down what the offer involves and the different ways you can apply.

We also compare it with the recently issued EABL bond and outline the key differences. Plus, we guide you through the simple steps to sign up digitally or through a placing agent.

Learn how it works.

That’s a wrap for this week’s Money Weekly!

Remember that we can help you compare over 300 loans, savings accounts, current accounts, and more on our website if you’re thinking about your next product.

❤️ Share with a friend

Thanks for reading. If you liked this week’s Wallet Wellness email, we’d love for you to share it with a friend.

If this email was forwarded to you, you can subscribe here.

.jpg)

%20(18).jpg)