- Money254 Money Weekly

- Posts

- Why KRA's New Powers Are a Wake-Up Call for Taxpayers & Small Business Owners

Why KRA's New Powers Are a Wake-Up Call for Taxpayers & Small Business Owners

Court grants KRA powers to tax unexplained bank and mobile money deposits. Treasury CS John Mbadi to table proposals in Parliament reducing PAYE rates. New NSSF rates to take effect in February. All these stories are in today’s Money Weekly Newsletter, but first, KRA's powers to tax unexplained bank deposits.

Hello and welcome to the Money Weekly Newsletter, where we are covering court rulings that have granted KRA powers to tax unexplained bank deposits.

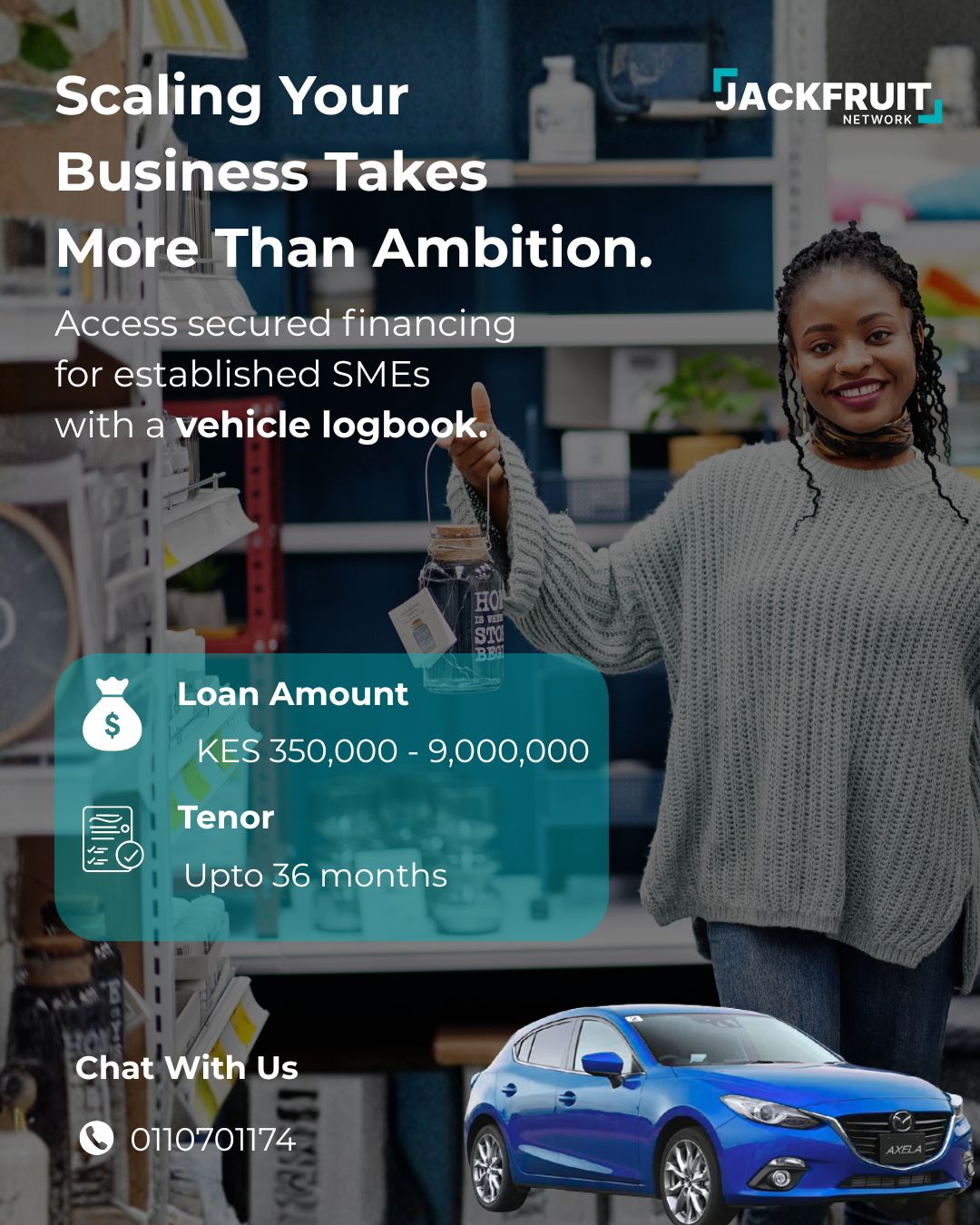

But first, a word from Jackfruit Finance.

Sponsored Content

Have you ever taken a loan for your SME where the interest stays fixed no matter how fast you repay?

With Jackfruit, you don’t get a fixed rate. You can access up to Ksh1 million and only pay interest on the outstanding balance, meaning the faster you repay, the less interest you are charged.

Why KRA's New Powers Are a Wake-Up Call for Taxpayers & Small Business Owners

Two separate court rulings have given the Kenya Revenue Authority (KRA) powers to treat unexplained bank and mobile money deposits as taxable income.

In the latest ruling delivered by the Tax Appeal Tribunal, it was upheld that the responsibility to prove that such deposits are not income rested on the shoulders of the taxpayer, such as a business.

In the dispute, KRA had sought a Ksh6 million tax from a Naivasha hotelier for money deposited in her bank and mobile money from 2018 to 2022. The deposits amounted to Ksh52 million.

During the court proceedings, the hotelier noted that KRA erred in demanding the Ksh6 million from her, stating that not all the money was income from the business.

However, the tribunal sided with the taxman and reiterated that it is upto a taxpayer to prove that the deposits are not income generated from the business.

Notably, in September 2025, the Tribunal also sided with KRA in its dispute with Kirin Pipes. The company had received Ksh57 million in its accounts. According to the company, part of this money was capital injections from their shareholders and a loan from a financial institution, therefore not taxable income.

On its part, KRA argued that the taxpayer failed to substantiate its claims. According to the taxman, the documents presented were either incomplete or unverifiable.

In the end, the Tribunal emphasized taxpayers carry the burden of proof under Section 56 of the Tax Procedures Act to demonstrate that such deposits do not constitute taxable income.

What does this mean for taxpayers and businesses? This decision is significant as it sets a clear precedent on how KRA can treat bank deposits when conducting tax audits. Businesses often receive funds from various sources that do not necessarily constitute taxable income, such as shareholder capital or loans. With businesses increasingly facing scrutiny of their bank accounts, the judgment reinforces the importance of maintaining clear financial records and documentation to avoid unnecessary disputes.

Withholding Tax Crackdown

Likewise, KRA has intensified its efforts to enhance compliance, which has included verification of tax records, including withholding Tax registrys.

As a result, the taxman has begun reminding Kenyans, especially those who are consultants, to file their tax returns and pay the outstanding taxes.

The recent move comes after KRA identified 392,162 firms and wealthy individuals owing unpaid taxes amounting to Ksh759.7 billion. It is reported that most of those targeted used to file nil returns or declare less earnings than those reported by third parties that sought their services.

Here is a quick recap of the top news stories for the week:

Treasury Cabinet Secretary John Mbadi has proposed exempting Kenyans earning Ksh30,000 and below from Pay As You Earn (PAYE) tax, a move aimed at easing the cost-of-living burden on low-income earners.

The new proposal will also see a lower tax rate for those earning between Ksh30,000 and Ksh50,000. The current 30% rate, which applies to incomes starting at about Ksh33,000 will be reduced to 25%.

Catch Up on More News

WEEKLY MONEY TIPS

MONEY254 #MONEYTOK

Most Profitable NSE Stocks by Dividend Payments

The Nairobi Securities Exchange (NSE) has recorded strong performance in recent years, supported by share price growth and dividend payouts.

For the financial year ending December 2024, several listed companies reported double-digit dividend yields. Liberty Kenya Holdings topped the list at 22%, followed by Standard Chartered Bank at 16.3%.

Watch this video to see which NSE stocks paid the highest dividends and how they ranked.

This analysis uses share prices as of December 30, 2024, to ensure fair comparison. Only companies with a December 31, 2024 financial year-end were included.

@money254hq 𝐌𝐨𝐬𝐭 𝐏𝐫𝐨𝐟𝐢𝐭𝐚𝐛𝐥𝐞 𝐍𝐒𝐄 𝐒𝐭𝐨𝐜𝐤𝐬 𝐁𝐲 𝐃𝐢𝐯𝐢𝐝𝐞𝐧𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 The Nairobi Securities Exchange (NSE) has recorded strong performance in recent years, sup... See more

That’s a wrap for this week’s Money Weekly!

Remember that we can help you compare over 300 loans, savings accounts, current accounts, and more on our website if you’re thinking about your next product.

❤️ Share with a friend

Thanks for reading. If you liked this week’s Wallet Wellness email, we’d love for you to share it with a friend.

If this email was forwarded to you, you can subscribe here.

%20(1).jpg)